Our progress toward a smoke-free future

1 Smoke-free business net revenues as of Q1 2024. All other figures are as of December 31, 2023.

Important Note: This information should be read in conjunction with the Philip Morris International Inc. earnings release

dated April 23, 2024, as well as the accompanying glossary of key terms, definitions,

explanatory notes, select financial information and reconciliations of non-GAAP financial measures, both of which are available on our Investor Relations pages.

The role of nicotine

Why invest in PMI?

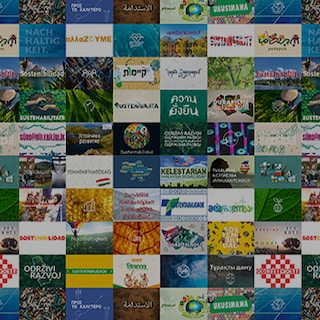

We've built the world’s most successful cigarette company. Now we’re building our future on smoke-free products that are much better choices.

Share Price PM (Common Stock)

$9502

-1.11 (-1.15%)

Latest news & press releases

Media Center-

Philip Morris International Reports First-Quarter 2024 Results and Updates Full Year Guidance

-

Philip Morris International to Host Webcast of 2024 First-Quarter Results

-

Philip Morris International Demonstrates Clear Progress Toward Its Purpose as It Releases 2023 Integrated Report

-

Philip Morris International Names New External Affairs Leader

This site is operated for the purpose of providing general information about us. The site is not operated for advertising or marketing purposes. The material on this site should not be regarded as an offer to sell, or a solicitation of an offer to buy, any product of PMI. Such products are sold only in compliance with the laws of the particular jurisdictions in which they are sold.