Integrated Report 2019

| INTEGRATED REPORT 2019 |

The public health benefit of smoke-free products depends not only on their potential to reduce the risk of smoking-related disease, but also on their actual use as alternatives to cigarettes by adult smokers. For consumers to use them, these alternatives must be accessible. With access we refer to four aspects: improving consumer awareness, acceptability, availability, and affordability of our smoke-free products.

Why it is important to us and our stakeholders

Innovative tobacco and nicotine products that have been scientifically substantiated as less harmful than smoking will realize their maximum potential for population harm reduction only when they are used in lieu of more hazardous tobacco products such as cigarettes. To achieve this aim, they should be globally accessible for smokers who want to continue using tobacco or nicotine products, while minimizing the use by unintended audience like youth and nonusers.

For PMI, developing scientifically substantiated smoke-free products is only the first step. The next is to make them accessible to all men and women currently smoking cigarettes or other combustible products. Our ability to do so successfully depends on various factors beyond our control, in particular government tobacco control policy and regulations. The commercialization of smoke-free products is at the core of our long-term value creation model.

Achieving our aims

It is our long-standing ambition that by 2025 at least 40 million smokers switch to PMI’s smoke-free products and completely stop smoking. This number can be much higher if more regulators make product harm reduction a third pillar of their tobacco public health strategy, in addition to preventing initiation and encouraging cessation. Our vision of a smoke-free future is an inclusive one. Within our global target of 40 million, we are aiming for at least 20 million smokers in non-OECD countries to switch to our smoke-free products. We have made good progress toward these objectives. We estimate that, by the end of 2019, a total of 9.7 million smokers had switched to IQOS and completely stopped smoking cigarettes, among them 3 million smokers in non-OECD countries. In the three years following the announcement of our smoke-free vision in 2016, PMI's smoke-free product shipment volume increased from 7.7 to 60 billion units. We actively accelerated the decline in shipment volume of our combustible tobacco products, which contracted from 845 billion to 732 billion over that time period.

Our aims:

>40m

number of adult smokers globally who switch to PMI smoke-free products by 2025

>20m

number of adult smokers in non-OECD countries who switch to PMI smoke-free products by 2025

>250bn

PMI's smoke-free product shipment volume by 2025

<550bn

PMI's combustible product shipment volume by 2025

In order to succeed in making the world smoke-free, we need to provide all adult smokers with access to PMI’s smoke-free products. By access we mean that:

smokers are aware of the existence and benefits of smoke-free products;

the products are acceptable to the smoker as a viable alternative to cigarettes;

the products are conveniently available for sale to the smoker; and

smoke-free products are affordable to the smoker.

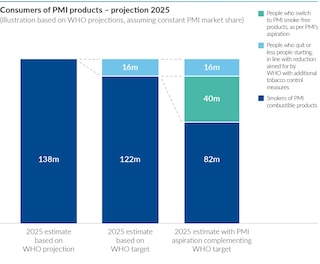

This section of the report elaborates on these four aspects of access. To assess the strength of our ambition, we put it in the context of the latest WHO base case projections.1 Based on these projections, which assume a world without smoke-free products, there would be 138 million smokers buying PMI cigarettes in 2025, at the current company market share. The WHO aims to further reduce smoking prevalence by strengthening measures to prevent smoking initiation and encourage cessation. Its 2025 target in this respect, translated to our consumer base, implies a 16 million reduction, equating to a total of 122 million smokers of PMI combustible products by 2025. Our smoke-free strategy supplements WHO efforts. If we succeed in our ambition to switch at least 40 million smokers to smoke-free products, there will be 82 million people smoking PMI's combustible products by 2025, compared to 138 million in the base case and 122 million as per WHO's target. This means that our aspiration is to reduce smoking more than three times faster than the target set by WHO. To achieve our objective, we are leveraging our resources to enhance awareness, acceptability, availability, and affordability of smoke-free products. Our commercial expenditure ratio is a good overall indicator of our efforts in this regard, showing how much of our total global spend on marketing, consumer engagement, and trade activities is dedicated to smoke-free products. In 2019, 71 percent of PMI’s commercial expenditures related to smoke-free products, far exceeding their share of total net revenues of 18.7 percent. While PMI is doing everything under its control by shifting resources, government policy and regulations play a key role in enabling and facilitating access, as will be described further in this section of the report.

Providing adult smokers access to our smoke-free products is top priority at PMI. In addition to the substantial resources, as explained above, we dedicate the vast majority of management time to the topic, from our entire Company Management team to the management teams in every market where we are commercializing, or plan to commercialize IQOS. Our Chief Operating Officer heads our efforts to roll out smoke-free products across our markets globally. The team led by PMI’s Chief Consumer Officer brings together all consumer-facing experiences across the consumer journey, from trends and insights on acquisition and retention communications, to physical and digital channel strategy. In conjunction, our Commercial team, headed by PMI’s Senior Vice President, Commercial, develops, tests, and deploys the routes to market for smoke-free products. Meanwhile, the team led by our Chief Product Officer continuously enhances and develops PMI smoke-free products, accounting for consumer feedback. Importantly, our Operations team, led by our Senior Vice President, Operations, works to ensure our manufacturing capabilities meet the demand for smoke-free products. Also, our External Affairs team, headed by PMI’s President, External Affairs and General Counsel, is at the forefront of our efforts to advocate for regulation and policies that will ultimately help adult smokers who would otherwise continue to smoke to change to better alternatives.

This cross-functional work is guided by PMI’s Guidebook for Success (our code of conduct) and overseen by specific internal policies such as those on responsible marketing and sales practices, market research, product development, and external communications and engagement.

Product awareness

The first component of our access strategy is raising awareness of smoke-free products among adult smokers. We want adult smokers to understand the difference and benefits of our smoke-free products in comparison with combustible cigarettes, but also make sure they understand that smoke-free products are addictive and not risk-free. In our awareness-raising efforts we remain cautious to guard against the use by unintended audiences such as never smokers, former smokers, and youth.

Throughout the world, tobacco product marketing is subject to extensive restrictions, including outright bans. The regulatory environment varies substantially across markets, making it more difficult – or almost impossible – in some countries than others to make people who smoke aware of alternatives to cigarettes and how and why they should use them.

Another significant hurdle is consumer confusion and misinformation that exists about the smoke-free category. People need accurate and non-misleading information to be able to make an informed decision. To illustrate the degree of misinformation that may exist, a recent study found that up to 73 percent of U.S. citizens mistakenly believe that nicotine causes cancer.2

To date, based on our post-market studies, we estimate that only 36 percent of adult smokers in the markets where PMI commercializes IQOS are aware of the product’s features and benefits compared with smoking cigarettes. This lack of information arguably presents the biggest hurdle to achieving our smoke-free vision. It is also potentially the easiest and fastest to overcome if and when public health organizations decide to inform, or allow the adult smokers to be informed, about the benefits of smoke-free products.

Product information

At PMI, we want to ensure that we provide our consumers with accurate and non-misleading information about our smoke-free products, so that adult smokers who would otherwise continue to smoke can make an informed choice. To this end, we have internal processes in place designed to ensure our consumer messages meet this standard. We also have developed a program of perception and behavior assessment studies to understand how our smoke-free products are perceived and how users will actually behave with those products.

Consumer messages about our product features and benefits are verified by a cross-functional team comprising scientists, market researchers, lawyers, communications experts, and marketers. In order to establish whether a statement is accurate (substantiated), the team verifies available information on product design and characteristics, or scientific evidence available either from the literature or directly from our scientific studies or consumer research. To confirm a message is clear and non-misleading, in particular for health messages, we organize comprehension research in various markets and carefully analyze the results before deciding to release the message at hand.

The team also works directly with markets to ensure proper deployment of consumer communication developed centrally, or that locally developed marketing materials meet our standard. Perception and behavior assessment studies help us to evaluate risk perceptions of smoke-free products among various adult consumer groups. The results of these studies show that adult consumer groups tested have a good understanding that IQOS presents less risk than cigarettes but is not risk-free, that it is not intended for nonsmokers, and that quitting the use of all tobacco is the best way to reduce the risk of tobacco-related disease. Such premarket research is complemented by post-market surveillance studies that help us adjust our messaging.

We do not conduct studies on youth; however, studies we have conducted on our heat-not-burn IQOS product among young adult never smokers between legal age (min. 18) and 25 years old suggest that our smoke-free products are not attractive to them, as evidenced by the very low levels of intention to try and intention to use, reported when they are exposed to various forms of IQOS-branded communications. Our premarket and post-market studies guide all our consumer-facing activities and communications, including the internal assessment of the consumer messages.

They also informed the development of our Good Conversion Practices, which serve as the bedrock for our engagement with adult smokers. The opinions expressed by public health organizations, regulatory bodies and NGOs about smoke-free products have a big impact on decisions made by individual smokers, so confusion must be avoided. It is essential to have an open, meaningful dialogue about the role smoke-free products can play in the improvement of public health and the effect current legislation in many countries has in preventing adult smokers from accessing accurate information. We appreciate that tobacco is an emotionally charged topic, but it is important for the hundreds of millions of smokers that science and facts prevail. We therefore are calling on leaders, policymakers, scientists, health professionals, and society as a whole to join this conversation – with the goal of achieving a future without cigarettes as soon as possible.

Consumer engagement at retail

To succeed in helping smokers to transition to smoke-free products, we are shifting from a business-to-business to a consumer-centric model. This is a highly complex and resource-intensive exercise. In the table below, we illustrate some of the dimensions of this change in our business model, illustrating the complexity and scale of the change we are undertaking. This transformation requires significant changes in our organization’s internal processes, skill set, and mindset. It requires substantial and long-term investment in infrastructure, systems, and capability building. Therefore, it has to be carefully paced by the company before scaling things up.

Purchasing and trying a smoke-free product is only one step along the conversion journey of an adult smoker who switches to a less harmful alternative. It is essential that we set in place the right infrastructure to support smokers along this journey. We currently have 23 consumer call centers where users can contact us if they have a question about the product itself or its use. Insights we receive are fed back into our product development.

At the end of 2019, PMI had a footprint of 199 stores dedicated to IQOS and over 3,000 exclusive IQOS retail touchpoints around the world. They offer personalized support to consumers, starting with explaining how the product should be used and how to clean it. In our boutiques, interested adult smokers can not only buy the product, but also receive education on the heated tobacco technology and its benefits, communicate with our staff, and try the product. Our IQOS coaches are trained on our Good Conversion Practices and required to interact only with adult smokers.

In addition to the IQOS stores, there are premium resellers; these are select stores in which we provide information about our smoke-free products to adult smokers, offering them an opportunity to have a session with trained staff about the product, its benefits, and explanations on how to use it, in the environment they regularly visit to purchase tobacco products. Additionally, IQOS users in these locations can access IQOS-related services such as cleaning of their devices by the premium reseller staff, replacing devices in case of defects, and experiencing and accessing new device ranges and accessories with which to personalize their IQOS products.

Digital capabilities help to become more efficient in serving consumers. In countries where this is permitted, adult smokers who express an interest in IQOS are offered the possibility to go through an online session with a remote IQOS coach.

Consumers can also benefit from additional services via other digital touchpoints. To do this, and with the consumer’s consent, we use our customer relationship management (CRM), which allows us to proactively offer tailored communications and

promotions to consumers, according to their specific interests and the stage of their consumer journey. It also allows us to process, analyze, and respond swiftly to consumer feedback collected across all touchpoints.

Our premarket and post-market studies guide all our consumer-facing activities and communications

Product acceptability

Smokers will only stop smoking and switch to better alternatives if these products are acceptable and meet their preferences. An important indicator in this regard is the so-called full-switching rate: the percentage of IQOS users that stopped smoking versus total IQOS users. In 2019, the average full-switching rate for IQOS was 71 percent. The perfect full-switching rate is 100 percent, and this is our ultimate goal as we continue to develop and improve our products.

Product design

Our smoke-free products are designed to reduce disease risk compared with smoking, while replicating as much as possible the taste, nicotine delivery, and ritual characteristics of cigarettes so that adults who smoke are willing to switch to these alternative products.

The likelihood that a smoke-free product will be considered a viable alternative to cigarettes by adult smokers relies on the overall sensory experience and nicotine delivery. With regard to nicotine, the FDA stated: “IQOS delivers nicotine in levels close to combustible cigarettes suggesting a likelihood that IQOS users may be able to completely transition away from combustible cigarettes and use IQOS exclusively.” We discuss in more detail the role of nicotine in our smoke-free products here.

The responsible use of flavors in smoke-free products also plays an important role in product acceptance. Some flavors are important to encourage adult smokers to switch and should be preserved, while others could be particularly appealing to youth and should not be used, such as those with candy or dessert-like descriptions. In all circumstances, we agree there is a need for government oversight on products and their marketing, so they do not appeal to youth.

To continuously enhance the product experience, we are guided by consumer insights throughout the journey of developing and improving smoke-free products, from the concept design stage to their commercialization at scale. This allows us to incorporate product updates and new features designed to address consumer pain points and help adult smokers switch from cigarettes more seamlessly. For example, IQOS 3 DUO, launched in 2019, allows for faster charging and two consecutive uses without recharging the holder.

Post-market studies and surveillance

We conduct post-market studies to understand how the product is used and by whom. These studies are necessary to confirm the results of the premarket perception and behavior assessments and to measure that current adult smokers switch to the product, while never and former smokers are not using it.

We have established IQOS adult owner

panels in 21 countries. These dynamic longitudinal studies, which involve in total about 110,500 participants, allow us to measure the usage patterns of IQOS adult owners over time. In Japan, we are conducting repeated cross-sectional surveys to measure trends of prevalence and patterns of IQOS use over time and to assess the impact of the product on public health. The results highlighted a very low rate of tobacco use initiation with IQOS (2 percent of adult IQOS users in 2017 and 1.3 percent in 2018) and a very low use in former smokers (only 0.1 percent of adult former smokers reinitiated tobacco use with IQOS). Additionally, results from an independent study commissioned by the Japanese Ministry of Health among middle- and high-school students found that the use of heated tobacco products among this group is extremely low and lower than smoking cigarettes.3

Overall, the data from our own studies, as well as independent studies, confirm that IQOS is reaching the intended audience, adult smokers, and is of very limited interest to adults who have never used nicotine products before or who had already stopped using tobacco.

We have established IQOS adult owner panels in 21 countries, involving about 110,500 participants

Product availability

Whether we can make our smoke-free products available to consumers depends on a number of essentially external factors. We need to understand a country’s regulatory conditions to decide whether it is legally possible and commercially viable to launch the product there. We then build sufficient production capacity, also depending on trade zones and tariff barriers. Lastly, we need to establish the right market organization to commercialize the product, ranging from how we will actually distribute the product up to establishing a full-fledged commercial organization that can implement the extensive consumer interaction described earlier in this section.

As of December 2019, our main smoke-free product, IQOS, was available in 52 markets, either in key cities or nationwide, and we estimate that in total over 120 million adult smokers worldwide could buy IQOS devices and consumables near where they live.

Production capacity

Expanding the sale of smoke-free products requires significant investment in our production capacity. In particular, the manufacturing of smoke-free product consumables requires that we build new factories or convert existing cigarette factories and increase our capital expenditure – for example, to purchase new machinery. As we are replacing cigarette sales with smoke-free products, we are also consolidating our cigarette factory footprint. In 2019, the discontinuation of cigarette manufacturing in select factories in Pakistan, Colombia, Argentina, and Germany resulted in significant restructuring. We aim to manage such transitions fairly and openly, promoting constructive engagement with employees and placing the emphasis on their continued employability (read more about our efforts to conduct effective labor relations).

Market launch

In 2019, we launched IQOS in eight additional markets, including Hungary, Mexico, Sweden, the UAE, and – via a licensing agreement with Altria Group, Inc. – the U.S. This brought to 52 the total number of markets where the product was commercialized as of year-end. Of these markets, 27 are OECD countries.

A number of countries, including Australia, India, Norway, and Singapore, do not permit the sale of heated tobacco and e-vapor products. We engage with stakeholders to advocate for allowing the sale of IQOS and other scientifically substantiated smoke-free products in these countries. We do not believe that banning such products is a rational policy, especially considering that these countries do permit the sale of the most harmful tobacco product: cigarettes.

In the U.S., the sale of heat-not-burn tobacco products is subject to an ex-ante regulatory authorization by the FDA. On April 30, 2019, the FDA authorized the sale of a version of IQOS, following a rigorous scientific assessment of PMI’s premarket tobacco product application, filed in 2017. Under an exclusive licensing agreement with PMI, Altria, Inc. started commercializing IQOS in the U.S. in the third quarter of 2019.

In addition to external factors, internal constraints also play a role in the rate at which we can roll out smoke-free products globally. PMI is present in over 180 markets, but the size and capacity of our local organizations vary. Not every market has the resources and capacity to launch smoke-free products immediately. We also evaluate the commercial viability of launching smoke-free products in a specific market to decide how to prioritize internal resources internationally.

Distribution channels

There are now 20 markets where our heat-not-burn product IQOS is supported commercially nationwide. In the other markets in which we have launched IQOS, the product initially is present in key cities, allowing PMI to gain experience and build capacity before we proceed with a nationwide rollout. We estimate at 60 percent the weighted-average geographic coverage in the 52 markets where IQOS was present as of the end of 2019, excluding the U.S.

Expanding the geographic availability of our smoke-free products requires that we leverage a variety of retail channels. In 2015, we started opening and running our own retail stores in markets where IQOS was present. These consumer touchpoints allow us to communicate and engage directly with adult smokers. They enable adult smokers to see, touch, and test the product where allowed. We rely on both stationary and temporary sales areas, with established flagship stores and pop-ups. As of the end of 2019, we had 199 permanent boutiques and stores worldwide, mainly in key cities and areas of high consumer traffic. Where legally permitted (i.e., in 30 countries), we also run e-commerce websites for IQOS allowing adult consumers to purchase the product online and have it delivered at home.4

The indirect retail environment consists of our traditional trade partners such as tobacco retailers, as well as key account chains such as convenience stores and petrol stations. Based on the product portfolio handled and the services provided to consumers, we classify the general trade and key accounts universe into three groups: consumable sellers, service points, and premium resellers. At consumable sellers, the main focus is to provide IQOS users with a convenient option to purchase the heated tobacco units on a regular basis. In service points, consumers can also access various services related to IQOS, such as replacement of the device in case of defect. Premium resellers offer consumers the full spectrum of services, including cleaning of devices and explanatory sessions, along with a full brand experience.

At the end of 2019, there were over 3,000 exclusive IQOS retail touchpoints5 around the world and around 679,000 points of sale where IQOS heated tobacco units are sold. We illustrate our distribution channels in our country-specific case studies.

Product affordability

We will only achieve a smoke-free future if all adult smokers who would not quit but like to switch to smoke-free products can afford to do so. Unlike with cigarettes, adult smokers who want to switch to IQOS must first buy an IQOS device. Their retail price ranges from around USD 40 to 115, depending on the model and country, with a geographical average price of the lowest cost IQOS device of USD 44. These high-quality devices have significant production costs to ensure they consistently function within the well-defined specifications that are part of the scientific substantiation package. To address the potential cost barrier for adult smokers who would like to switch, we have implemented various solutions, including initial lending of the device or payment over time, and we have lowered the price of the existing IQOS device versions following the launch of newer versions. We also improved battery performance, thus improving the longevity of the devices. This not only helps to lower the average annual costs for the user, it also improves IQOS' ecological footprint.

A second aspect of affordability relates to the price of the consumable. At the moment, the production costs of IQOS heated tobacco units are somewhat higher than those of cigarettes, on average. Heated tobacco units undergo a special manufacturing process that is vastly different from the manufacturing of cigarettes, and the products require an increased level of quality assurance in factories. We also incur other costs that are not applicable to cigarettes, such as the costs of scientifically substantiating the reduced-risk profile of these products.

Importantly, IQOS has much higher commercialization costs compared to cigarettes that result from the need to properly introduce consumers to this new product and explain its functioning, such as the costs related to our customer care call centers and follow-up with them during their conversion journey so that they do not fall back into smoking. Generally speaking, the more restrictive the regulatory environment, the more difficult it is to effectively commercialize our smoke-free products and therefore the higher the costs related to commercialization.

Beyond costs, a key factor driving tobacco product retail prices is excise tax. Excise taxes on cigarettes are generally higher than those on smoke-free products, and within the smoke-free category, electronic cigarettes tend to be lower taxed compared with heat-not-burn tobacco products. As a result of the combined effect of cost and tax differences, the price to the consumer of IQOS heated tobacco units is typically below the price of premium cigarettes and sometimes, as in New Zealand and the U.K., at the low end of the combustible tobacco products pricing. We estimate that heated tobacco units are priced the same or lower than a smoker’s current cigarette brand for 47.8 percent of smokers in the geographies where we currently commercialize IQOS. In Japan, we started to launch IQOS heated tobacco units at different price points in order to extend the reach among adult smokers.

Clearly, to achieve our vision of a smoke-free future, our smoke-free products must be affordable to all adult smokers within each market. The same reasoning applies across countries. We aim for our smoke-free products to be commercialized in all countries and have a dedicated team focused on lower- and middle-income countries.

To date, our smoke free-products are available in 15 upper-middle-income countries: Albania, Armenia, Belarus, Bosnia and Herzegovina, Bulgaria, Colombia, Dominican Republic, Guatemala, Kazakhstan, Malaysia, Mexico, Romania, Russian Federation, Serbia, and South Africa. They are also available in two low- and lower-middle-income countries: Moldova and Ukraine.

We are only at the beginning of commercializing a full-fledged portfolio of smoke-free products and realize that additional efforts are necessary. We continue to work on developing a variety of product platforms, including devices and consumables with different price points.

Furthermore, we are exploring alternative business models and routes to market. A recent example is the global collaboration agreement announced in early 2020 with the South Korean tobacco company KT&G, which offers the opportunity to broaden our portfolio and to offer consumers a wider range of taste, price, and technology choices. The KT&G portfolio includes lil Hybrid, lil Mini, and lil Vapor products.

A challenge to attaining greater product affordability is the fact that the commercialization of our smoke-free products requires significant upfront investments in R&D, production, and commercial infrastructure. We expect those costs to lower over time, as we gain experience and scale.

We are exploring alternative business models and routes to market

Next steps

Our long-standing aspiration is that by 2025 at least 40 million people will have stopped smoking and switched to our smoke-free products. To achieve this ambitious goal, we will need to work on all four access drivers: awareness, acceptability, availability, and affordability. This in turn requires that we continue to massively shift resources across our company toward smoke-free products.

We have expanded our business transformation metrics introduced three years ago to provide further transparency about the scale and speed at which we are moving. We now also report on the number of stock keeping units (SKUs) that we produce within the cigarette category as well as heated tobacco products. Since announcing our smoke-free vision in 2016, we delisted over 600 cigarette SKUs globally, while significantly broadening our portfolio of heated tobacco units, to over 400 SKUs.

With the planned launch of IQOS VEEV, PMI will enter the e-vapor product category in more countries, providing additional smoke-free options to completely replace cigarettes.

We will continue to do everything within our ability to give all smokers who want to continue using tobacco or nicotine products full access to our smoke-free products. There are many factors outside of our own control. Governments in particular can accelerate the end of smoking. They can play a key role in providing accurate information to smokers about smoke-free products and introducing product standards to ensure that only scientifically substantiated smoke-free products are commercialized. Governments can also provide the right incentives to smokers and producers, through regulation and taxation.

1Projections are based on the WHO Global Report on Trends in Prevalence of Tobacco Use 2000-2025, third edition (December 2019)

4As of year-end 2019, our smoke-free devices and heated tobacco units could be purchased through e-commerce websites in 19 markets. Additionally, e-commerce websites run in 11 markets allowed the online purchase of smoke-free devices only.

5Touchpoints relate to all permanent and temporary retail touchpoints, where IQOS is sold exclusively (boutiques, flagship stores, pop-ups, shop-in-shop, and corners).This online supplement to our integrated report should be read in conjunction with PMI’s Integrated Report 2019. The information and data presented in this online supplement cover the 2019 calendar year or reflect status at December 31, 2019, worldwide, unless otherwise indicated. Where not specified, data come from PMI estimates. See About this online supplement for more information. Aspirational targets and goals do not constitute financial projections, and achievement of future results is subject to risks, uncertainties and inaccurate assumptions, as outlined in our forward-looking and cautionary statements.