Stock, dividends and bonds

Find information on our share price, dividend schedule and history, and owning PMI stock, as well as information on the company’s outstanding bonds.

Annual dividend

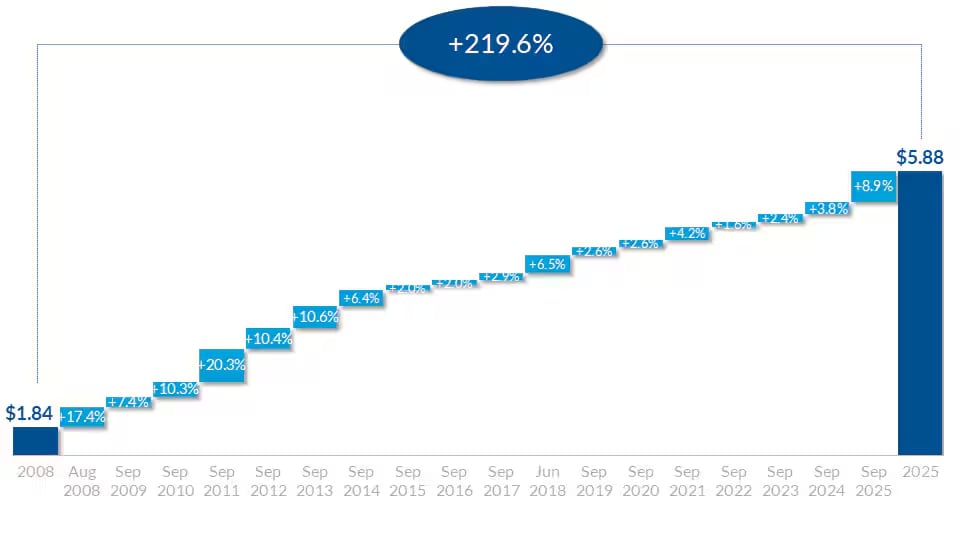

PMI has increased its annual dividend every year since becoming a public company in 2008, representing a total increase of 219.6%, or a compound annual growth rate of 7.1%.

Dividend schedule

Dividends are declared and approved at the discretion of the Board of Directors. The anticipated dividend dates have been adjusted to fit the calendar of Board meetings. Dates chosen for Board meetings take into account a variety of factors, including other items on the corporate calendar and the schedules of Directors.

| DECLARATION DATE | EX-DIVIDEND DATE | RECORD DATE | PAYMENT DATE |

|---|---|---|---|

| March 5, 2026 | March 19, 2026 | March 19, 2026 | April 13, 2026 |

| June 11, 2026 | June 25, 2026 | June 25, 2026 | July 20, 2026 |

| September 18, 2026 | October 2, 2026 | October 2, 2026 | October 26, 2026 |

| December 10, 2026 | December 24, 2026 | December 24, 2026 | January 20, 20271 |

1Dividend statement will be accompanied by Tax Form 1099

Owning PMI stock

If you hold your shares with a financial institution, such as a bank or broker, and want information about your account, please contact your financial institution directly. If you hold stock certificates or you hold stock in our dividend-reinvestment plan, you can manage your account through services offered via the Investor Center of our transfer agent, Computershare.

Contact details

Computershare Trust Company, N.A.

Address

P.O. Box 43078

Providence, RI 02940-3078

U.S.A.

Phone

+1 877 745 9350

Call toll-free within the U.S. and Canada

+1 781 575 4310

Direct dial from outside the U.S. and Canada

Email

pmi@computershare.com

*Bond information

| ISIN Number | Currency | Nominal Amount | Coupon | Issue Date | Maturity Date | Offering Format |

|---|---|---|---|---|---|---|

| US718172CR89 | USD | 750,000,000 | 0.875% | Nov 02, 2020 | May 01, 2026 | S-3 Shelf |

| XS2035473748 | EUR | 500,000,000 | 0.125% | Aug 01, 2019 | Aug 03, 2026 | S-3 Shelf |

| US718172DF33 | USD | 750,000,000 | 4.750% | Feb 13, 2024 | Feb 12, 2027 | S-3 Shelf |

| US718172CB38 | USD | 500,000,000 | 3.125% | Aug 17, 2017 | Aug 17, 2027 | S-3 Shelf |

| US718172DM83 | USD | 750,000,000 | 4.375% | Nov 1, 2024 | Nov 1, 2027 | S-3 Shelf |

| US718172CV91 | USD | 1,500,000,000 | 5.125% | Nov 17, 2022 | Nov 17, 2027 | S-3 Shelf |

| US718172CZ06 | USD | 1,550,000,000 | 4.875% | Feb 15, 2023 | Feb 15, 2028 | S-3 Shelf |

| US718172CE76 | USD | 500,000,000 | 3.125% | Nov 02, 2017 | Mar 02, 2028 | S-3 Shelf |

| US718172DS53 | USD | 400,000,000 | SOFR + 0.83% | Apr 30, 2025 | Apr 28, 2028 | S-3 Shelf |

| US718172DR70 | USD | 750,000,000 | 4.125% | Apr 30, 2025 | Apr 28, 2028 | S-3 Shelf |

| US718172DC02 | USD | 650,000,000 | 5.250% | Sep 7, 2023 | Sep 7, 2028 | S-3 Shelf |

| US718172EB10 | USD | 300,000,000 | SOFR + 0.66% | Oct 29, 2025 | Oct 27, 2028 | S-3 Shelf |

| US718172DX49 | USD | 750,000,000 | 3.875% | Oct 29, 2025 | Oct 27, 2028 | S-3 Shelf |

| US718172DG16 | USD | 1,000,000,000 | 4.875% | Feb 13, 2024 | Feb 13, 2029 | S-3 Shelf |

| XS1066312395 | EUR | 500,000,000 | 2.875% | May 13, 2014 | May 14, 2029 | S-3 Shelf |

| XS3087812593 | EUR | 500,000,000 | 2.750% | Jun 6, 2025 | Jun 6, 2029 | S-3 Shelf |

| US718172CJ63 | USD | 750,000,000 | 3.375% | May 01, 2019 | Aug 15, 2029 | S-3 Shelf |

| US718172DN66 | USD | 750,000,000 | 4.625% | Nov 1, 2024 | Nov 1, 2029 | S-3 Shelf |

| US718172CW74 | USD | 1,250,000,000 | 5.625% | Nov 17, 2022 | Nov 17, 2029 | S-3 Shelf |

| US718172DA46 | USD | 2,200,000,000 | 5.125% | Feb 15, 2023 | Feb 15, 2030 | S-3 Shelf |

| US718172DT37 | USD | 750,000,000 | 4.375% | Apr 30, 2025 | Apr 30, 2030 | S-3 Shelf |

| US718172CP24 | USD | 750,000,000 | 2.100% | May 01, 2020 | May 01, 2030 | S-3 Shelf |

| US718172DD84 | USD | 700,000,000 | 5.500% | Sep 7, 2023 | Sep 7, 2030 | S-3 Shelf |

| US718172DY22 | USD | 750,000,000 | 4.000% | Oct 29, 2025 | Oct 29, 2030 | S-3 Shelf |

| US718172CS62 | USD | 750,000,000 | 1.750% | Nov 02, 2020 | Nov 01, 2030 | S-3 Shelf |

| XS2837884746 | EUR | 500,000,000 | 3.750% | Jun 6, 2024 | Jan 15, 2031 | S-3 Shelf |

| US718172DH98 | USD | 1,250,000,000 | 5.125% | Feb 13, 2024 | Feb 13, 2031 | S-3 Shelf |

| XS2035474126 | EUR | 750,000,000 | 0.800% | Aug 01, 2019 | Aug 01, 2031 | S-3 Shelf |

| US718172DP15 | USD | 750,000,000 | 4.750% | Nov 1, 2024 | Nov 1, 2031 | S-3 Shelf |

| XS3087812833 | EUR | 500,000,000 | 3.250% | Jun 6, 2025 | Jun 6, 2032 | S-3 Shelf |

| US718172CX57 | USD | 1,500,000,000 | 5.750% | Nov 17, 2022 | Nov 17, 2032 | S-3 Shelf |

| US718172DB29 | USD | 2,250,000,000 | 5.375% | Feb 15, 2023 | Feb 15, 2033 | S-3 Shelf |

| XS0940697187 | EUR | 500,000,000 | 3.125% | Jun 03, 2013 | Jun 03, 2033 | S-3 Shelf |

| US718172DE67 | USD | 1,000,000,000 | 5.625% | Sep 7, 2023 | Sep 7, 2033 | S-3 Shelf |

| US718172DJ54 | USD | 1,750,000,000 | 5.250% | Feb 13, 2024 | Feb 13, 2034 | S-3 Shelf |

| US718172DQ97 | USD | 750,000,000 | 4.900% | Nov 1, 2024 | Nov 1, 2034 | S-3 Shelf |

| US718172DU00 | USD | 600,000,000 | 4.875% | Apr 30, 2025 | Apr 30, 2035 | S-3 Shelf |

| US718172EA37 | USD | 850,000,000 | 4.625% | Oct 29, 2025 | Oct 29, 2035 | S-3 Shelf |

| XS1408421763 | EUR | 500,000,000 | 2.000% | May 09, 2016 | May 09, 2036 | S-3 Shelf |

| XS1716245094 | EUR | 500,000,000 | 1.875% | Nov 08, 2017 | Nov 06, 2037 | S-3 Shelf |

| US718172AC39 | USD | 1,500,000,000 | 6.375% | May 16, 2008 | May 16, 2038 | S-3 Shelf |

| XS2035474555 | EUR | 750,000,000 | 1.450% | Aug 01, 2019 | Aug 01, 2039 | S-3 Shelf |

| US718172AM11 | USD | 750,000,000 | 4.375% | Nov 15, 2011 | Nov 15, 2041 | S-3 Shelf |

| US718172AP42 | USD | 700,000,000 | 4.500% | Mar 20, 2012 | Mar 20, 2042 | S-3 Shelf |

| US718172AU37 | USD | 750,000,000 | 3.875% | Aug 21, 2012 | Aug 21, 2042 | S-3 Shelf |

| US718172AW92 | USD | 850,000,000 | 4.125% | Mar 04, 2013 | Mar 04, 2043 | S-3 Shelf |

| US718172BD03 | USD | 750,000,000 | 4.875% | Nov 12, 2013 | Nov 15, 2043 | S-3 Shelf |

| US718172BL29 | USD | 1,250,000,000 | 4.250% | Nov 10, 2014 | Nov 10, 2044 | S-3 Shelf |

* The list does not include notes issued by Swedish Match AB