For more than a decade, PMI has leveraged technology and science to develop, assess, and commercialize better alternatives to cigarettes. We are disrupting our business to replace cigarettes with science-based products that do not combust and therefore have the potential to present less risk of harm compared with cigarettes. Heated tobacco products and e-cigarettes are examples of such smoke-free products.

While cigarettes remain the largest part of PMI’s business in terms of net revenues and shipment volume in most countries today, this is changing rapidly.

Over time, the shift of adult smokers away from cigarettes to smoke-free alternatives can play an important role in helping countries achieve the ambitious smoking reduction targets set by the WHO and other organizations and eventually ending smoking. Minimizing tobacco-related harm at the population level depends not only on the degree of risk reduction of the smoke-free products, but also on their adoption by adults who would otherwise continue to smoke. It is important that these people switch completely in large numbers, whilst product initiation by nonsmokers—including youth and ex-smokers—must be minimized.

In 2020:

This case study responds to calls from researchers and public health policy experts for better understanding of the population level impact of the increasing availability and uptake of our IQOS heat-not-burn product.

It aims to provide a high-level synthesis of some of the data that can be used to assess initial population level impacts of the introduction of IQOS. We use market share data measured at the retail level to determine acceptance and sales volumes at the national level to estimate any effects that the uptake of IQOS has had on the evolution of sales volume of other tobacco products. We also describe PMI’s approach to post-market monitoring, provide information from national prevalence surveys, and, finally, discuss the potential of real-world evidence to improve our understanding of the product’s health impact before data from prospective epidemiological studies is available.1

Inevitably, the level of evidence for each of these elements varies by country. While we have relevant data from a number of geographies on product acceptance, the national-level sales volumes can be meaningfully examined only once the product reaches sufficient penetration.

In this case study, we limited the analysis to selected countries where heated tobacco products generally, and IQOS specifically, constitute around one tenth or more of the total tobacco product sales volume, namely Japan, Lithuania, Latvia, and Italy.

Japan, the first country where IQOS was launched originally in late 2014 as a city pilot, remains the country with the highest number of heated tobacco product users in the world. It has the highest share of market of heated tobacco products and as a result, it is the most appropriately positioned country to examine prevalence of heated tobacco product use using national survey data. It is also the most likely candidate country where real-world evidence on health outcomes may become available in the foreseeable future.

There is no single conclusive data point that can provide a full picture of the impact of a new tobacco product on consumer behavior and public health, in particular, for a product that has been on the market over a relatively short period of time. Consequently, each layer of evidence discussed in this case study has inherent limitations.

2020 was also affected by the COVID-19 pandemic. For example, it is very likely that the pandemic materially impacted sales volumes across many markets. A large portion of duty-free purchases are likely to have shifted to the domestic market, while reduced cross-border tourism and shopping is likely to have led to significant fluctuations in domestic sales. Countries with high inbound visitor traffic in other years may have seen decreased domestic sales of tobacco products, while in other countries’ sales likely increased as consumers remained at home and purchased tobacco products locally. The pandemic also impacted consumption patterns as many users may have had more private occasions to use tobacco products at home, while social occasions were significantly limited.

Even with these limitations, we believe that this case study can offer valuable insights that can contribute to the evaluation of the population level impact of our heat-not-burn product. We hope that it can provide the basis for an open, transparent and constructive dialogue, and we welcome stakeholder feedback.

1. Market share

Consumer offtake share, typically from a smaller geography, such as a city, is one of the earliest indicators whether a new tobacco product, such as IQOS, is acceptable to consumers. Offtake share represents the estimated retail offtake volume (sales from retailer to consumer) of heated tobacco units (HTUs) divided by the sum of estimated total offtake volume for cigarettes and HTUs. The data is collected from a selection of retail sales channels that vary by market. The first cities where PMI introduced IQOS were Nagoya, Japan, and Milan, Italy, in November 2014 and, by the end of 2020, IQOS was available in 64 geographies. In 2020, the offtake share of PMI’s heated tobacco units (HTUs) exceeded 10% in many cities across Asia and Europe:

This city-level data shows that IQOS has significant potential for acceptance among adult smokers in geographies representing a wide variety of consumer preferences and purchasing power.

2. National in-market sales volume data

As IQOS is rolled out more broadly within a market and its share reaches a certain level, we can begin to examine the impact of IQOS in the context of the entire market. To do this, we use in-market sales (IMS) volume, which reflects sales to the retail channel, depending on the market and distribution model.

While sales volume data can be a valuable tool to examine market trends, they are impacted by factors that limit their use for understanding the full extent of changes in consumer behavior. These factors include but are not limited to:

- Changes in the frequency of use, i.e., consumers may increase or decrease their daily consumption, which can significantly impact sales without necessarily affecting underlying prevalence;

- The proportion of illicit products; and/or

- The magnitude of legal cross-border sales.

Importantly, to better understand transition patterns between different product categories, it is necessary to obtain reliable sales volume data. While such data generally exists for cigarettes, heated tobacco units, and other tobacco products, it is generally not the case for e-cigarettes. Further, there is no agreed standard for converting different product formats—such as e-cigarette cartridges—into a common volume equivalent (e.g., cigarette).2 Therefore, the impacts of e-cigarettes are excluded from this analysis.

Most of these challenges are not present in Japan, where just three main product categories exist—cigarettes, heated tobacco products, and cigarillos—and all of which are essentially used by smokers in the same way as cigarettes. The use of e-cigarettes with nicotine is rare due to regulation.3

The chart below shows the IMS volume evolution (in billions of sticks) of different product categories over the past decade in Japan. It shows an accelerating decline in cigarette sales following the national roll-out of IQOS in 2016.

Other third-party researchers have observed a similar trend of accelerated decline of cigarette sales following the introduction of IQOS, while the overall trend of declining total tobacco product sales volume remained virtually unchanged.4, 5

In other countries, especially in Europe, the marketplace is much more complex:

- In several countries, contraband and counterfeit cigarettes are estimated to represent more than 10% of the domestic cigarette consumption, with the highest being Greece (22% in 2019), followed by Lithuania and Ireland (both 18%), the UK (17%), Latvia, France and Cyprus (all 14%), and Romania (12%).

- Cigarette sales are also affected by legal cross-border shopping and tourism, facilitated by open borders and price differences.

- Other combustible tobacco products make up a significant proportion of consumption in some markets. For example, in Belgium, Hungary, and the Netherlands, the combined sales volume of combustible tobacco products other than cigarettes—such as fine-cut tobacco, pipe tobacco, cigarillos, and cigars—is virtually as large as cigarettes, while fine-cut tobacco represents around one-third of the combined cigarette and fine-cut tobacco market in the UK.

- Finally, the prevalence of e-cigarette use is generally higher in Europe than in Japan.

Without accounting for these limitations, the data on legal sales of tobacco products from the European countries analyzed in this case study (Italy, Lithuania, and Latvia) suggests that the introduction of heated tobacco products coincided with the acceleration of combustible tobacco product volume declines—in particular, cigarettes—when comparing annual average declines between 2011 and 2020 with the period between the year in which the share of HTUs in all tobacco products reached at least 1% and 2020 (which was in 2018 for Italy and Lithuania and in 2019 for Latvia).

While sales volume and market share data can be an important signal indicating the shift in consumer patterns, additional studies over a longer period of time are necessary to obtain data that is granular enough to be able to detect and quantify a substitution effect.

3. PMI’s post-market studies

When IQOS is rolled out more broadly within a market, we are able to deploy our post-market assessment program to understand how the product is used and by whom.

General population and IQOS user survey data are some of the key elements of the program aimed to provide information on key measures such as prevalence and patterns of use. They include:

- Surveys in a sample that is representative of the general adult population to estimate the prevalence of current use of tobacco- and nicotine-containing products;

- Cross-sectional surveys in the random sample drawn from the registered IQOS users in the owner databases to describe the behavior of IQOS users and their history of tobacco use; and

- Longitudinal panels and cross-sectional adoption trackers to estimate the total population of IQOS users, the number of adult smokers who switched to IQOS and stopped smoking, as well as insights such as the reasons for use or barriers to switching.

The results show that the prevalence of use of IQOS has been increasing. At the same time, its use remains confined almost entirely to those who had already smoked with very low rates of initiation in never-tobacco or nicotine users, former smokers, or youth.

The results from our heated tobacco product user panels and adoption trackers also show that a large proportion of IQOS purchasers abandon cigarettes. The panel and adoption tracker data is used not only to estimate the rate of switching, but also to estimate the number of users of PMI’s heated tobacco products worldwide.

Based on the collected data, we determine average daily consumption of heated tobacco products and cigarettes over the past seven days, which is used alongside sales volume data to estimate the total number of IQOS users as well as the number of users who switched to IQOS and stopped smoking.

⎼ for markets where there are no heat-not-burn products other than PMI heat-not-burn products: daily individual consumption of PMI HTUs represents the totality of their daily tobacco consumption in the past seven days

⎼ for markets where PMI heat-not-burn products are among other heat-not-burn products: daily individual consumption of HTUs represents the totality of their daily tobacco consumption in the past seven days, of which at least 70% is PMI HTUs

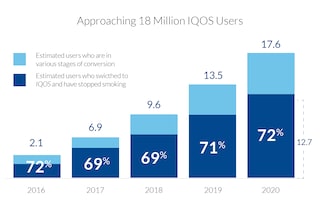

Source: PMI Financials or estimates, IQOS user panels and PMI Market Research

Based on the data from IQOS user panels and adoption trackers, we estimate that by year-end 2020, there were almost 18 million IQOS users worldwide. These are adult IQOS users who reported using PMI heated tobacco units (HTUs) for at least 5% of their daily tobacco consumption over the past seven days.

Almost 13 million, or 72%, of the total are estimated to have switched to IQOS and stopped smoking. This number reflects users who have not smoked any cigarettes over the past seven days and for whom PMI’s HTUs represented at least 70% of their consumption of heated tobacco products.

4. Government surveys

Well-designed surveys conducted by regulators and public health agencies can provide important information on the prevalence of use of heated tobacco products as well as how these products are being used.

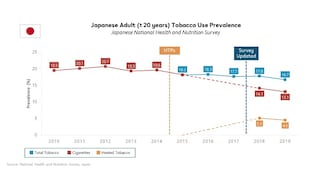

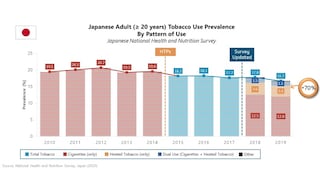

The National Health and Nutrition Survey in Japan is a good example. The prevalence of use of heated tobacco products is high enough to provide reliable results and the survey methodology, including survey questions, as well as detailed results, are publicly available. In 2018, the survey began to systematically measure not only the prevalence of cigarette smoking but also heated tobacco product use.

The results are striking: Until 2014, around a fifth of the Japanese adult population smoked cigarettes. By 2019, the prevalence of cigarette smoking by adults declined to 13.1%, while the overall tobacco use prevalence reached an all-time low of 16.7%.

Importantly, the survey also showed that over 70% of heated tobacco product users were no longer smoking.

The survey data on heated tobacco product use in other countries remains limited. Most countries do not have a history of measuring heated tobacco product use, and their reliability and comparability may suffer from methodological challenges, which may include:

- Inconsistent questions about cigarette smoking compared to use of new tobacco and nicotine products,

- Ability to differentiate between regular use and trial,

- Absence of agreed-upon terminology around new tobacco and nicotine products that is understood by survey respondents, and

- Sample sizes that may be sufficient to measure cigarette smoking prevalence and patterns of use but insufficient to achieve the same objective with adequate precision for new products with much lower number of users.

There is an urgent need to initiate a dialogue on the development of survey instruments that can adequately and reliably measure the prevalence and patterns of use of emerging product categories, including heated tobacco products.

Footnotes

1Where not specified, data come from PMI estimates.

2PMI uses the following conversion of other combustible tobacco product categories to stick equivalents whereby 1 cigarette equals: 1 heated tobacco unit; 0.73g make-your-own tobacco; 0.60g make-your-own volume tobacco; 0.75g pipe tobacco; 0.60g roll-your-own tobacco; 1 cigarillo; 1 cigar.

3Nicotine-containing e-cigarettes are regarded as medicinal products under the law. Therefore, approval is needed by the Ministry of Health to be sold. To date, no nicotine-containing e-cigarette has been approved. However, nicotine-free e-cigarettes are not subject to this restriction.

4See Stoklosa M, Cahn Z, Liber A, Nargis N, Drope J. Effect of IQOS introduction on cigarette sales: evidence of decline and replacement. Tob Control. 2020 Jul;29(4):381-387. doi: 10.1136/tobaccocontrol-2019-054998. Epub 2019 Jun 17. PMID: 31209129.

5Cummings KM, Nahhas GJ, Sweanor DT. What Is Accounting for the Rapid Decline in Cigarette Sales in Japan? Int J Environ Res Public Health. 2020 May 20;17(10):3570. doi: 10.3390/ijerph17103570. PMID: 32443663; PMCID: PMC7277739.