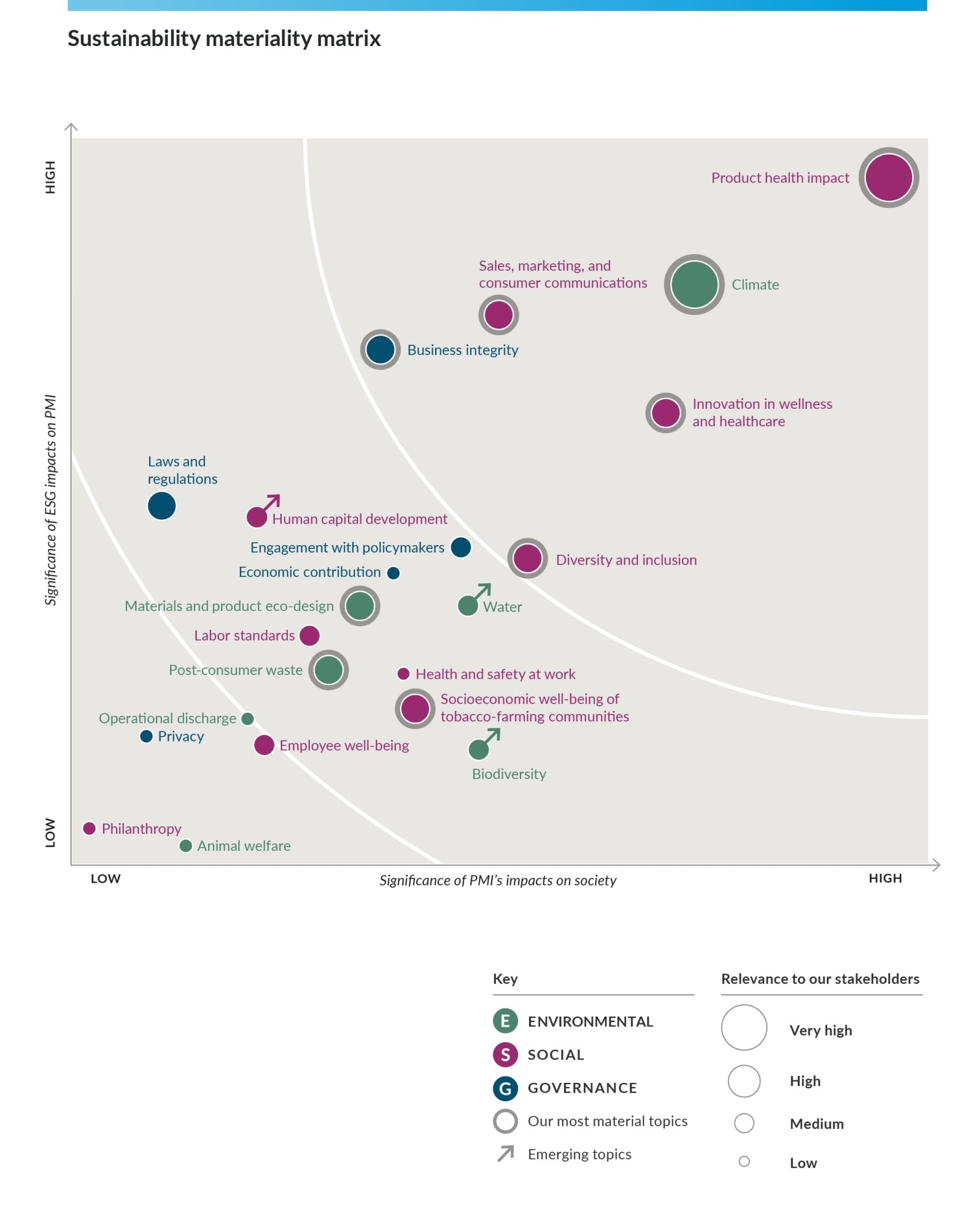

Sustainability is at the core of PMI’s business strategy, and is an opportunity for innovation, growth, and the long-term value creation of the company. Our sustainability materiality assessment forms the foundation of PMI’s sustainability strategy. It helps us to ensure that our efforts remain focused on those areas where we can have the greatest impact, and that we continue to deliver relevant reporting to our stakeholders. To keep pace with our business transformation toward a smoke-free future and constantly evolving stakeholder priorities, it’s necessary to regularly update our sustainability materiality assessment.

We conducted our last sustainability materiality assessment in 2018 and refreshed it in 2019. In the second half of 2021, we expanded our assessment in line with the principles of “double” materiality. This consists of a threefold approach that evaluates both outward and inward impacts, but also accounts for stakeholder expectations and perceptions of these impacts. The results of the assessment provided the basis to restructure our strategic framework.

What is a sustainability materiality assessment?

The updated framework includes two distinct forms of social and environmental impacts: Those that derive from PMI’s products (what we produce); and those that derive from our business activities (how we operate). The framework separates these two kinds of impacts and highlights their corresponding ESG factors.

While they are clearly connected and interdependent, framing these different impacts and their origin in this way crystallizes both our inputs and desired outcomes, and brings clarity to our organization in terms of how best to allocate resources and incorporate sustainability into our ways of working. It also offers clarity to our external stakeholders, who can better understand our approach to sustainability from an impact perspective.

Topics related to the social impacts generated by PMI’s products—including “product health impacts,” “sales, marketing, and consumer communications,” and “wellness and healthcare”—were identified as a clear priority and represent those areas with the greatest transformative potential for the company.

Following a structured approach

PMI’s 2021 assessment followed a structured five-step approach, namely: (1) Identifying ESG topics; (2) gathering internal and external stakeholder perspectives; (3) assessing outward impacts; (4) assessing inward impacts; and (5) identifying the most material ESG topics. PMI identified six topics that cumulatively received the highest scores in both the inward and the outward impact assessments, as well as three topics that were of very high importance according to stakeholders. Finally, PMI identified three topics that were not included in the list of most sustainability material topics but are expected to gain momentum in the future.

Going forward, PMI plans to conduct a comprehensive sustainability materiality assessment every three to four years. This global assessment will be complemented by local ones across various markets, with local findings embedded in global assessment updates.

“It’s critical to conduct sustainability materiality assessments regularly, since this is a dynamic process that evolves over time, explained Jennifer Motles, PMI’s Chief Sustainability Officer. “The approach requires continuous monitoring of ESG issues, their integration in risk assessment processes, and transparent reporting, as well as strong corporate governance and oversight.”

To learn more about how PMI conducted its extended sustainability materiality assessment, download our 2021 Sustainability Materiality Report, or click on the link below.

Note: In the Sustainability Materiality Report 2021 and in related communications, the terms “materiality,” “material,” and similar terms, when used in the context of economic, environmental, and social topics, are defined in the referenced sustainability standards, and are not meant to correspond to the concept of materiality under the U.S. securities laws and/or disclosures required by the U.S. Securities and Exchange Commission.