Our Sustainability Index and Sustainability KPI Protocol should be regarded as a framework and reference guide to help provide consistency and completeness in our reporting and should be read in conjunction with our annual Integrated Report.

Sustainability Index

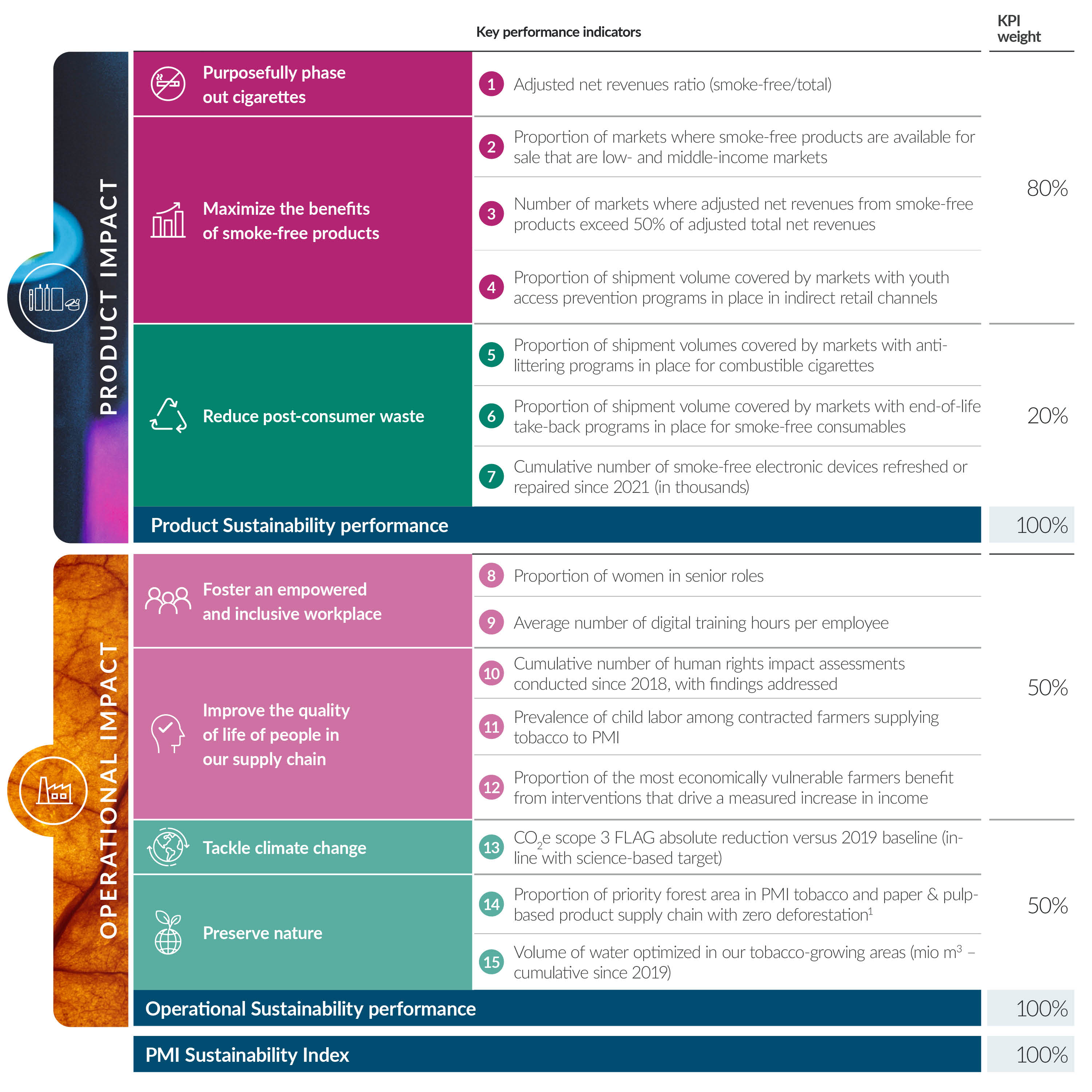

In 2021, we developed PMI’s Sustainability Index to measure objectively and communicate rigorously progress towards our aspirations, using a set of clearly defined and verifiable metrics. Our Sustainability Index is comprised of KPIs that are aligned with our 2025 Roadmap.

Index weighting

The Index is composed of a set of KPIs which are connected to our eight sustainability strategies and related goals of our 2025 Roadmap.

Read moreANNUAL TARGETS AND PERFORMANCE RANGES

In our Integrated Report, we disclose key goals connected to our eight sustainability strategies, which collectively form our 2025 Roadmap.

Read moreLink to long-term executive compensation

Our long-term executive compensation program reflects our commitment to position sustainability at the core of our corporate strategy.

Read moreSustainability KPI Protocol

The Sustainability KPI Protocol (the Protocol) establishes a framework, which is specific to our company and clearly defines KPIs that can provide our organization with a method for making the connection between our company’s purpose, strategic direction, financial performance, and environmental and social considerations. It includes the definitions, methodology, and scope of each of the Index’s KPIs to provide measurable, verifiable, consistent, and accurate reporting on progress.

It is key to the integrity of our reporting that the information and data that we publicly disclose accurately reflect our company’s performance, following clear calculation methods.

Through the publication of this Protocol, we aim to provide further transparency on the key metrics we use to measure how our company is delivering on its purpose and creating value for our shareholders and other stakeholders

PMI’s Sustainability KPI Protocol and Sustainability Index act as a tool to engage employees at all levels of the organization, support program owners by ensuring key sustainability initiatives are prioritized, and act as a vessel through which we continue to build capabilities within our financial, IT, and risk management functions regarding management of sustainability performance. Externally, it allows us to communicate with rigor, accuracy, and credibility our annual progress using a robust data-driven approach to managing our most material sustainability-related risks.

“As sustainability matures and gains importance inside and outside our company, the question of how to measure sustainability performance is something many continue to grapple with,” said Jennifer Motles, PMI’s Chief Sustainability Officer.

“There is a need for greater transparency, more robust methodologies, and better clarity on definitions and assumptions. Accordingly, we developed a clear process for establishing concrete definitions, documentation, and controls for sustainability with the aim of standardizing how we measure sustainability performance.”

Externally, the Protocol helps ensure that the non-financial data we disclose is reliable, comparable, and meaningful, allowing shareholders and other stakeholders to assess and track progress in a consistent manner over time.

Internally, the Protocol offers clear guidelines on sustainability-related data management to support integrated decision-making within our company, accounting for both financial and non-financial information.

In addition, the Protocol offers the necessary basis to expand the scope of our external verification, helping build preparedness for anticipated regulatory requirements, including the need for external verification, increasing shareholders’ and other stakeholders’ confidence in our reporting.

We will review the Protocol periodically to reflect relevant developments, such as changes in business priorities, revised methods of measuring or capturing data, stakeholder feedback, and developments related to mandatory and voluntary reporting frameworks and standards.

This online content about our Integrated Report should be read in conjunction with PMI’s Integrated Report 2024. This report includes metrics that are subject to uncertainties due to inherent limitations in the nature and methods for data collection and measurement. The precision of different collection and measurement techniques may also vary. This report includes data or information obtained from external sources or third parties. Unless otherwise indicated, the data contained herein cover our operations worldwide for the full calendar year 2024 or reflect the status as of December 31, 2024. Where not specified, data comes from PMI financials, nonfinancials, or estimates.

Unless explicitly stated, the data, information, and aspirations in this report do not incorporate PMI’s wellness and healthcare business, Aspeya. Regarding the Swedish Match acquisition, completed late 2022, unless otherwise indicated, this report includes information pertaining to its sustainability performance. Please also refer to "This report at a glance" on page 2 of the PMI’s Integrated Report 2024 for more information. Aspirational targets and goals do not constitute financial projections, and achievement of future results is subject to risks, uncertainties and inaccurate assumptions, as outlined in our forward-looking and cautionary statements on page 206. In PMI’s Integrated Report 2024 and in related communications, the terms “materiality,” “material,” and similar terms are defined in the referenced sustainability standards and are not meant to correspond to the concept of materiality under the U.S. securities laws and/or disclosures required by the U.S. Securities and Exchange Commission.